- 10x Trading Strategy

- Posts

- Crypto Stocks: Understand What is Moving in the Market and Why.

Crypto Stocks: Understand What is Moving in the Market and Why.

Strategize Your Digital Asset Investment Strategy

MACRO

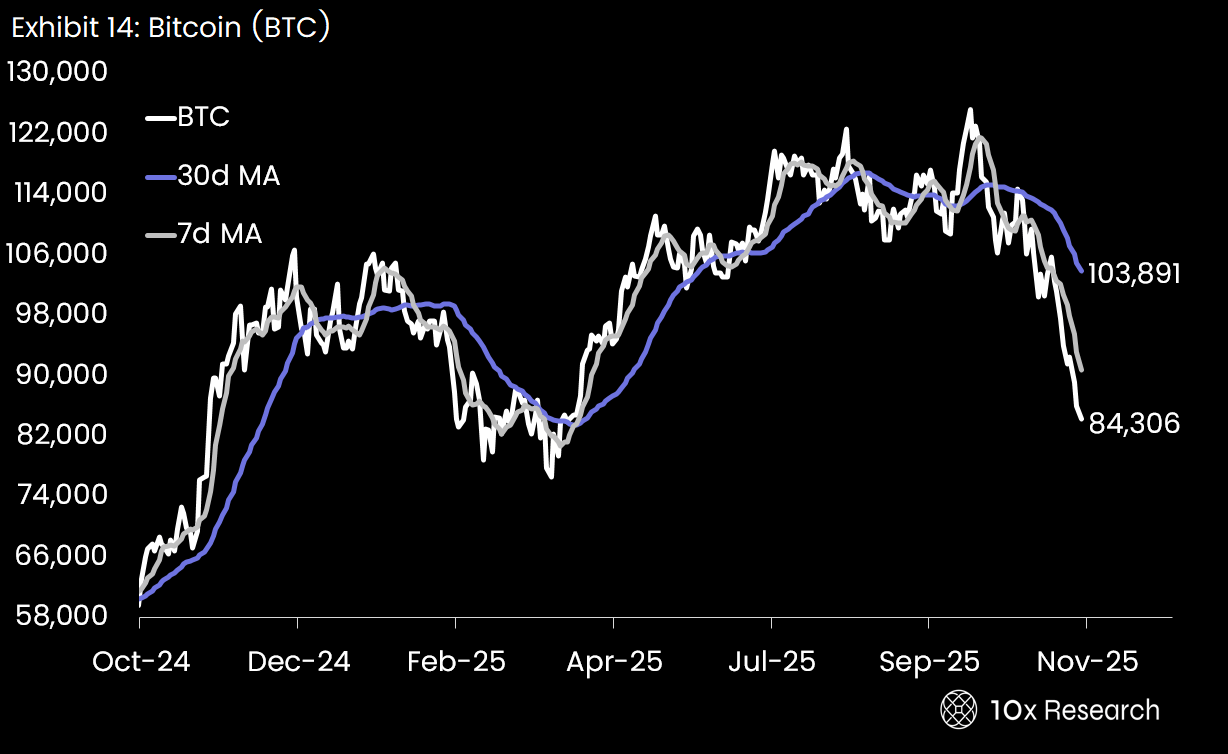

Bitcoin (BTC is below the 7-day moving average -> bearish, and is below the 30 day moving average -> bearish, with 1 week change of -16.7%) erasing $800 billion in market value. Hawkish Fed signals on interest rates, including reduced odds of a December cut, have intensified the sell-off, pushing BTC below key support levels and sparking $8.25 billion in liquidations over the past month. Bitcoin ETFs recorded nearly $2.3 billion in outflows over five days, reflecting institutional caution despite some sovereign funds like Abu Dhabi's tripling holdings. Long term holders, including a 2011-era whale, offloaded billions, short-term holders face $21.5 billion in unrealized losses.

Trading Strategy

Become a paying subscriber of Trading Strategy to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

Sharper Analysis. Trusted Community. Confident Decisions:

- • Everything in Market Updates, Trading Signals and more:

- • Full coverage across digital currencies and crypto-linked equities (stocks).

- • Weekly Chart Book on Top Crypto stocks Movers and What’s Driving Them.

- • Weekly Chart Books with 30 key daily, weekly, and monthly charts.

- • Twice-monthly on-chain insights driving market cycle clarity.

- • Twice-monthly Bitcoin derivatives insights with actionable option trades.

- • Regular Strategic reports that sharpen clarity and strengthen conviction.