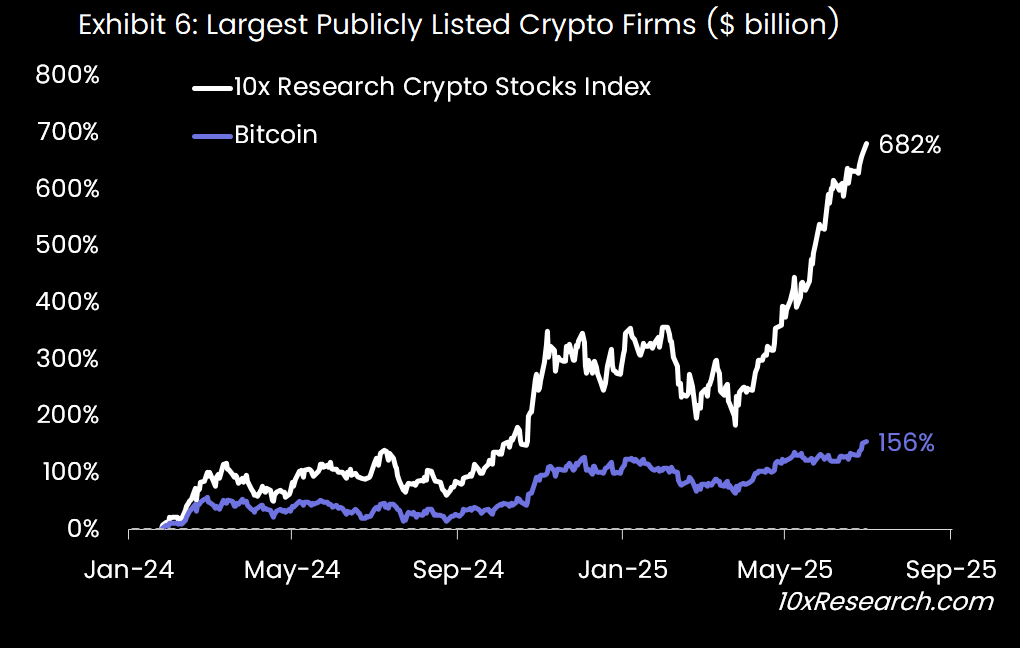

MicroStrategy’s market capitalization has surged to $126 billion, while Coinbase has hit $100 billion, leaving them roughly 6% and 13% overvalued, respectively. Most crypto stocks lagged behind Bitcoin’s +11% rally over the past week. Notably, large-cap Bitcoin miners outperformed their smaller peers, indicating that institutional investors are increasingly using them as a proxy for Bitcoin exposure. Major crypto equities—especially MicroStrategy, Coinbase, and Robinhood—have moved largely in line with Bitcoin, underscoring strong correlation at the top of the market. Metaplanet has underperformed during the last week.

Trading Strategy

Become a paying subscriber of Trading Strategy to get access to this post and other subscriber-only content.

UpgradeMost comprehensive, unbiased digital asset research for traders and institutions:

- Includes ALL Market Updates (8-16x per month) AND

- Includes ALL Trading Signals (4-8x per month) AND

- Includes ALL Trading Strategy Reports (6-8x per month), AS BELOW:

- Crypto Fundamentals: Monthly Overview (1x per month)

- Crypto Fundamentals: Tactical Ideas (1-2x per month)

- On-Chain Analysis: Monthly Overview (1x per month)

- Macroeconomic Factors Impacting Bitcoin (1x per month)

- Quant Model Analysis for BTC (1x per month)

- Technical Analysis Chart Book (Daily, Weekly, Monthly charts) (1-2x per month)

- Access to 10x Research Strategy 'Model Portfolio'

- Ad hoc comments - and more...

- --------

- Our clients include hedge funds, traders, liquidity providers, exchanges, family offices, proprietary traders, institutions, high-net-worth individuals (HNWIs), CEOs of major listed Bitcoin mining companies, executives from crypto service providers, TradeFi portfolio managers, etc.